Crypto Zoo: This innovative concept merges the exciting world of cryptocurrencies with a vibrant ecosystem of digital assets and decentralized applications. Imagine a digital menagerie where unique digital creatures, each with its own attributes and value, interact within a blockchain-based environment. This exploration delves into the technical infrastructure, economic models, security considerations, user experience, and legal aspects of this burgeoning field, highlighting both its potential and challenges.

From understanding the core components and different cryptocurrency types within a Crypto Zoo ecosystem to examining real-world examples, this analysis provides a comprehensive overview. We’ll unpack the technological underpinnings, including blockchain technology and smart contracts, and explore various tokenomics models, comparing their advantages and disadvantages. Crucially, we will address security and privacy concerns, designing a user interface and outlining a user journey for seamless interaction.

Defining “Crypto Zoo”

A Crypto Zoo is a multifaceted concept encompassing a decentralized ecosystem where various cryptocurrencies and blockchain-based projects interact and potentially interoperate. It’s characterized by a diverse range of digital assets, often with unique functionalities and purposes, coexisting within a shared digital environment. Think of it as a vibrant, interconnected digital habitat where different cryptocurrencies thrive and interact, much like the diverse species within a real-world zoo.

The core components of a Crypto Zoo typically include a diverse range of cryptocurrencies, decentralized applications (dApps) built on various blockchains, and often, a governing token that facilitates transactions and participation within the ecosystem. The level of integration and interoperability between these components can vary significantly, depending on the specific design and goals of the Crypto Zoo. Successful Crypto Zoos foster innovation and collaboration, offering users a rich and dynamic experience.

Types of Cryptocurrencies within a Crypto Zoo Ecosystem

A Crypto Zoo can house a variety of cryptocurrencies, each serving a specific role. These might include utility tokens facilitating transactions within the ecosystem, governance tokens granting voting rights to holders, stablecoins providing price stability, non-fungible tokens (NFTs) representing unique digital assets, and memecoins, adding a layer of community-driven engagement. The exact mix and relative importance of these cryptocurrency types will depend on the particular Crypto Zoo’s design and the needs of its users. For example, a Crypto Zoo focused on gaming might heavily feature NFTs representing in-game assets, while one centered on decentralized finance (DeFi) might emphasize stablecoins for stable value transactions.

Examples of Real-World Projects Resembling a Crypto Zoo

While the term “Crypto Zoo” isn’t widely used in the industry, several existing projects exhibit characteristics aligning with this concept. For example, the Solana ecosystem boasts a thriving community of projects built on its high-throughput blockchain, including DeFi protocols, NFTs marketplaces, and gaming platforms, all interacting within a shared environment. This could be considered a de facto Crypto Zoo, given the diversity of its components and the interoperability between them. Similarly, the Cosmos ecosystem, with its interconnected network of blockchains, allows for the exchange of tokens and data between different projects, creating a network resembling a more expansive and interconnected Crypto Zoo. These examples illustrate how the concept of a Crypto Zoo can emerge organically through the development and interaction of various blockchain projects.

The Technological Infrastructure of a Crypto Zoo

A Crypto Zoo, at its core, is a decentralized application (dApp) built upon blockchain technology and leveraging smart contracts to manage and interact with digital assets representing unique animals or creatures. Its infrastructure ensures transparency, security, and immutability in the ownership and trading of these digital assets, creating a verifiable and auditable ecosystem. The underlying technology allows for a secure and engaging experience for users, fostering a community around the collection and trading of these virtual creatures.

Blockchain Technology in Crypto Zoos

Most Crypto Zoos utilize a blockchain, typically Ethereum or a similar compatible platform, to record and verify transactions involving the digital animals. The blockchain’s distributed ledger ensures transparency, preventing fraud and manipulation. Each transaction, such as breeding, selling, or transferring ownership, is recorded as a block on the chain, creating a permanent and verifiable history. This immutability is crucial for maintaining the integrity of the Crypto Zoo ecosystem and providing users with confidence in the authenticity of their digital assets. The chosen blockchain’s features, such as gas fees and transaction speeds, directly impact the user experience and overall functionality of the Crypto Zoo.

Smart Contracts for Digital Asset Management

Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller directly written into lines of code. Within a Crypto Zoo, smart contracts automate various processes. These include managing the breeding mechanics of digital animals (defining rarity, traits passed down, and probabilities), enforcing ownership transfers, and facilitating the auction or direct sale of digital assets. The code governing these smart contracts is publicly available and auditable, promoting transparency and trust. For example, a smart contract might automatically distribute a percentage of a sale to the original creator of a specific digital animal, or it might enforce breeding restrictions to maintain rarity. The robust nature of smart contracts ensures that all transactions are executed automatically and fairly according to predefined rules, without the need for intermediaries.

Simplified Architecture of a Crypto Zoo

| Component | Description |

|---|---|

| Blockchain Network (e.g., Ethereum) | The underlying distributed ledger that records all transactions and asset ownership. Provides security and transparency. |

| Smart Contracts | Self-executing contracts that automate processes like breeding, trading, and ownership transfer of digital animals. Enforce the rules of the Crypto Zoo. |

| Crypto Zoo Frontend | The user interface (website or app) allowing users to interact with the Crypto Zoo, view digital assets, breed animals, and participate in the marketplace. |

| Database | Stores metadata about the digital animals, such as their traits, rarity, and ownership history. This database interacts with the smart contracts and blockchain. |

| API | An application programming interface that connects the frontend to the blockchain and smart contracts, facilitating communication and data transfer. |

Economic Models within a Crypto Zoo

The economic model of a Crypto Zoo is crucial for its long-term viability and success. A well-designed system incentivizes participation, encourages breeding and trading, and maintains a healthy in-game economy. The choice of model significantly impacts the value of in-game assets and the overall player experience. Several approaches exist, each with its own set of advantages and disadvantages.

Tokenomics Models for a Crypto Zoo

Several tokenomics models could underpin a Crypto Zoo’s economy. These models dictate how the in-game currency (or currencies) are generated, distributed, and utilized within the ecosystem. Careful consideration of these models is essential for creating a balanced and sustainable virtual environment.

Comparison of Economic Models: Play-to-Earn vs. Play-and-Earn

A prominent example is the contrast between Play-to-Earn (P2E) and Play-and-Earn (P&E) models. P2E models, popularized by games like Axie Infinity, focus heavily on direct monetary rewards for gameplay. Players earn cryptocurrency by completing tasks or breeding and selling in-game assets. This can lead to rapid initial growth but is vulnerable to market fluctuations and potential for unsustainable inflation. In contrast, P&E models emphasize the intrinsic value of gameplay, integrating earning opportunities more subtly. Rewards might be less frequent but more stable, creating a more sustainable and potentially longer-lasting ecosystem. P&E often focuses on building community and creating a compelling game experience alongside the financial aspects.

A Hypothetical Economic Model: The “Genesis Zoo” Model

Let’s consider a hypothetical Crypto Zoo called “Genesis Zoo.” This model utilizes two tokens: $GENESIS (governance token) and $CREATURE (utility token). $GENESIS is earned through participation in governance votes, breeding rare creatures, and contributing to community development. $CREATURE is earned through daily gameplay, completing quests, and participating in breeding events. $CREATURE can be used to purchase in-game items, breed new creatures, and pay for various services within the zoo. Both tokens have a capped supply, preventing excessive inflation. A portion of transaction fees from both tokens is burned, further controlling supply. Furthermore, a percentage of $CREATURE earned through gameplay is automatically converted to $GENESIS, creating a natural bridge between utility and governance. This system aims to create a balanced ecosystem where players are incentivized to both play the game and participate in its governance. The Genesis Zoo model aims for a sustainable P&E model, leveraging the benefits of both approaches while mitigating the risks associated with pure P2E models. This dual-token system allows for a more nuanced and flexible economic approach, fostering both player engagement and long-term sustainability.

Security and Privacy Considerations

The decentralized nature of a Crypto Zoo, while offering benefits like transparency and immutability, also introduces unique security and privacy challenges. The interconnectedness of smart contracts, digital assets, and user data necessitates a robust security framework to protect against various threats. Effective mitigation strategies are crucial to maintain the integrity and trustworthiness of the Crypto Zoo ecosystem.

Smart contracts, while automating processes, can be vulnerable to exploits if not carefully designed and audited. Similarly, the management of digital assets, including NFTs representing virtual creatures, requires secure storage and transfer mechanisms to prevent theft or loss. Furthermore, the balance between transparency—a key feature of blockchain—and user privacy needs careful consideration to protect sensitive information.

Smart Contract Security Vulnerabilities and Mitigation

Smart contracts form the backbone of a Crypto Zoo, controlling breeding, trading, and other functionalities. Potential vulnerabilities include reentrancy attacks, where malicious contracts drain funds by recursively calling functions; overflow/underflow errors, which can lead to unexpected behavior and asset loss; and logic errors that can be exploited by attackers. Mitigation strategies include rigorous code audits by independent security firms, employing formal verification techniques to mathematically prove contract correctness, and using established security patterns and best practices in smart contract development. Furthermore, implementing timelocks and pausing functionalities in case of emergencies allows for swift response to potential exploits. For example, a well-known case involved a vulnerability in a DeFi protocol’s smart contract that allowed attackers to drain millions of dollars. Thorough audits and robust security measures could have prevented this incident.

Digital Asset Management and Security

Securely managing digital assets, such as NFTs representing the Crypto Zoo creatures, is paramount. Users need robust wallets with strong private key management, ideally employing multi-signature wallets or hardware wallets for enhanced security. The platform itself should implement measures to prevent unauthorized access and transfer of assets, such as implementing robust authentication mechanisms and regularly auditing its own internal systems. Furthermore, integrating mechanisms for asset recovery in case of compromised accounts could mitigate user losses. The use of trusted custodians or decentralized storage solutions with appropriate access controls can also improve security. A real-world example of the importance of secure asset management is the numerous instances of NFT theft resulting from compromised wallets or phishing scams.

Privacy Concerns and Data Protection

While blockchain transactions are transparent, user data linked to those transactions should be protected. This requires careful consideration of data minimization principles, collecting only the necessary information and ensuring its secure storage. Techniques like zero-knowledge proofs can allow for verification of certain facts without revealing sensitive details. Anonymization techniques can also be employed to protect user identities while maintaining transaction transparency on the blockchain. Furthermore, the Crypto Zoo platform should adhere to relevant data privacy regulations, such as GDPR, to ensure compliance and build user trust. A potential privacy concern is the linkage of on-chain transaction data with off-chain user profiles, which could expose sensitive information. Robust data protection measures and adherence to privacy regulations are crucial to mitigating this risk.

The User Experience in a Crypto Zoo

A seamless and intuitive user experience is crucial for the success of any Crypto Zoo. The platform must be accessible to users with varying levels of technical expertise, from casual gamers to seasoned cryptocurrency investors. A well-designed interface, coupled with a clear user journey, will foster engagement and encourage long-term participation within the virtual ecosystem.

The design should prioritize simplicity and clarity, minimizing technical jargon and maximizing ease of navigation. Visual appeal is also important, creating an immersive and engaging experience that reflects the unique nature of the Crypto Zoo. This will encourage users to actively participate in the various activities offered within the platform.

User Interface Design

The following key features should be incorporated into the user interface of a Crypto Zoo:

- Dashboard: A centralized hub displaying key information such as owned assets, current market value, pending transactions, and upcoming events.

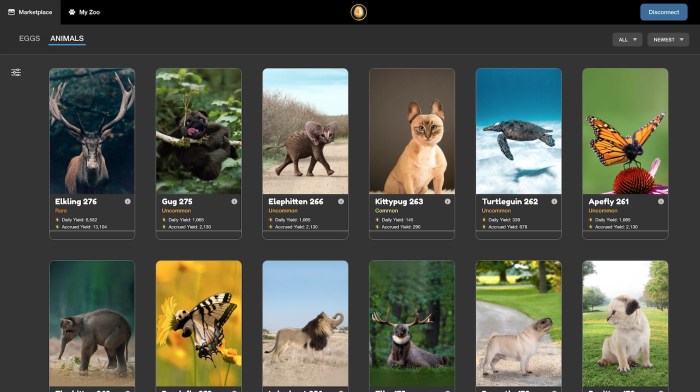

- Marketplace: A user-friendly interface for browsing, buying, and selling digital assets within the Crypto Zoo. Filters and search functionalities are essential for efficient navigation.

- Zoo Management: Tools for managing owned creatures, including breeding, training, and battling options. Clear visual representations of creature stats and abilities are crucial.

- Wallet Integration: Secure integration with various cryptocurrency wallets, allowing for seamless deposits and withdrawals.

- Game Progress Tracking: Clear display of progress within the game, including achievements, leaderboard rankings, and rewards earned.

- Community Features: Integrated chat functionality, forums, or social media integration to foster community engagement and collaboration.

- Educational Resources: In-app tutorials, FAQs, and a glossary of terms to help users understand the intricacies of the Crypto Zoo ecosystem.

User Journey

The user journey begins with account creation, a process that should be straightforward and secure, potentially incorporating multi-factor authentication. Once registered, users can explore the marketplace, acquire digital assets, and begin managing their virtual zoo. This involves breeding creatures, engaging in battles, and participating in community events. Regular updates and notifications will keep users informed about new features, market changes, and upcoming events. A robust help center and customer support system should be readily available to address any questions or issues users may encounter. The overall experience should be rewarding and engaging, encouraging users to continuously interact with the platform.

User Roles and Functionalities

Different user roles within the Crypto Zoo will have access to varying levels of functionalities. This tiered system allows for a more balanced and engaging gameplay experience.

- Casual Player: Access to basic features such as browsing the marketplace, purchasing creatures, and engaging in simple battles. Limited access to breeding and advanced features.

- Dedicated Breeder: Enhanced breeding functionalities, access to rare creatures, and potentially exclusive breeding events. Focus on optimizing creature genetics and creating powerful offspring.

- Competitive Battler: Access to advanced battle strategies, specialized training options, and participation in high-stakes tournaments. Focus on strategic gameplay and competitive ranking.

- Investor: Focus on market analysis and investment strategies. Access to detailed market data and tools for managing their cryptocurrency portfolio within the Crypto Zoo.

- Moderator/Administrator: Oversees community engagement, enforces rules, and resolves disputes. Access to administrative tools for managing the platform.

Legal and Regulatory Aspects

The legal landscape surrounding Crypto Zoos is complex and rapidly evolving, presenting significant challenges for developers and operators. The decentralized nature of blockchain technology, combined with the novel integration of virtual and real-world elements, creates ambiguities in existing legal frameworks. Understanding these complexities is crucial for responsible development and operation.

The regulatory framework applicable to Crypto Zoos varies considerably depending on jurisdiction. No single, universally accepted regulatory approach exists. This necessitates a careful, jurisdiction-specific analysis for each potential deployment location.

Applicable Regulatory Frameworks

Several existing regulatory frameworks could potentially apply to Crypto Zoo operations, depending on their specific features and business model. These frameworks are often interconnected and overlapping, requiring careful consideration. For example, securities laws might apply if the in-game assets are deemed securities. Consumer protection laws would be relevant to ensure fair play and transparency to users. Tax laws will apply to any profits generated. Data protection and privacy regulations are crucial given the collection and use of user data. Gambling laws may also be relevant, depending on the design of the game and the nature of rewards. Anti-money laundering (AML) and know-your-customer (KYC) regulations will likely be necessary to prevent the use of Crypto Zoos for illicit activities.

Navigating Legal and Regulatory Complexities

Navigating the legal and regulatory landscape requires a multi-pronged approach. Thorough legal due diligence is paramount before launching a Crypto Zoo. This involves identifying all potentially applicable laws and regulations in each target jurisdiction. Seeking legal counsel specializing in blockchain technology and gaming law is crucial to ensure compliance. Proactive engagement with regulatory bodies is advisable to foster a collaborative relationship and clarify ambiguities. Transparent and user-friendly terms of service, privacy policies, and risk disclosures are essential for mitigating legal risks and building trust with users. Structuring the Crypto Zoo in a way that minimizes regulatory exposure, such as using decentralized autonomous organizations (DAOs) where appropriate and complying with relevant licensing requirements, is a key consideration. Continuous monitoring of evolving regulations and adapting the Crypto Zoo’s operations accordingly are also essential for long-term success and compliance. The specific strategies will vary based on the chosen jurisdiction, the business model of the Crypto Zoo, and the level of risk tolerance. For example, operating in a jurisdiction with a more established regulatory framework for blockchain technology and gaming might be preferred, even if it means facing stricter requirements, over operating in a jurisdiction with unclear or uncertain regulations. This allows for a clearer understanding of compliance obligations and potentially minimizes future legal risks.

Community and Governance

A thriving Crypto Zoo ecosystem necessitates a robust and participatory governance structure. Effective community management ensures the long-term success and sustainability of the project, fostering trust and encouraging active involvement from all stakeholders. This section explores various governance models and mechanisms for community participation in a Crypto Zoo environment, showcasing how a Decentralized Autonomous Organization (DAO) can effectively manage such a complex system.

The choice of governance model significantly impacts the Crypto Zoo’s direction, responsiveness to community needs, and overall efficiency. Different models offer varying degrees of decentralization and community control. A well-defined governance framework promotes transparency, accountability, and fairness, fostering a positive and engaged community.

Governance Models for a Crypto Zoo Community

Several governance models can be implemented within a Crypto Zoo community, each with its own strengths and weaknesses. These models range from centralized control to fully decentralized structures. The optimal choice depends on the specific goals and priorities of the Crypto Zoo project.

- Centralized Governance: A single entity or a small group holds ultimate decision-making power. This model offers efficiency but risks becoming unresponsive to community needs and concerns.

- Hybrid Governance: This model combines elements of both centralized and decentralized governance. A central team retains some control while allowing the community to participate in decision-making through voting or proposals. This approach attempts to balance efficiency with community input.

- Decentralized Governance: Decision-making power is distributed among community members, often through a DAO. This approach fosters community ownership and participation but can be slower and more complex to manage.

Mechanisms for Community Participation and Decision-Making

Effective community participation is crucial for a successful Crypto Zoo. Mechanisms must be established to facilitate communication, proposal submission, voting, and conflict resolution. Transparency and clear processes are essential to build trust and maintain a healthy community.

- Forums and Communication Channels: Dedicated online forums, social media groups, and communication platforms are essential for community members to interact, share ideas, and provide feedback.

- Proposal Submission and Voting Systems: A clear process for submitting proposals, including criteria for evaluation and a transparent voting system, is crucial for community-driven decision-making. This might involve weighted voting based on token holdings or a more complex system that considers factors beyond simple token ownership.

- Dispute Resolution Mechanisms: Establishing a fair and transparent process for resolving disputes among community members is vital to maintain a positive and productive environment. This could involve mediation, arbitration, or other conflict resolution methods.

DAO Management of a Crypto Zoo

A Decentralized Autonomous Organization (DAO) can effectively manage a Crypto Zoo by automating processes, enhancing transparency, and ensuring community ownership. The DAO’s smart contracts govern the Crypto Zoo’s operations, enforcing rules and decisions made by the community.

A DAO-managed Crypto Zoo might use smart contracts to automate tasks such as breeding, selling, and trading digital creatures. Community members could propose changes to the Crypto Zoo’s parameters, such as breeding rules or in-game rewards, through proposals that are voted on by the DAO. The DAO’s treasury, potentially funded through sales of in-game assets, would be managed according to the community’s decisions. This structure offers a high degree of transparency and decentralization, fostering community ownership and trust. For example, the MakerDAO, known for its DAI stablecoin, operates on a similar decentralized governance model, where community members vote on key parameters and proposals related to the platform’s operations. This demonstrates the viability of DAO governance for complex systems requiring transparency and community participation.

Scalability and Sustainability

The success of any Crypto Zoo hinges on its ability to scale efficiently while maintaining a sustainable ecosystem. As the number of users and digital assets increases, several challenges emerge that require proactive solutions to ensure long-term viability and prevent system overload or environmental damage. Addressing scalability and sustainability is crucial for building a robust and responsible Crypto Zoo.

The primary scalability challenge lies in handling a large influx of transactions and user interactions. Increased user base necessitates higher transaction processing speeds and lower latency to maintain a positive user experience. The underlying blockchain technology, smart contracts, and associated infrastructure must be capable of handling this increased load without compromising performance or security. Furthermore, the storage requirements for user data and digital assets will grow exponentially, demanding efficient data management solutions.

Scalability Strategies

Maintaining a high level of performance as the user base grows requires a multi-pronged approach. This involves optimizing the underlying blockchain technology for faster transaction speeds, potentially through sharding or layer-2 scaling solutions. Efficient data management strategies, such as employing database technologies optimized for large datasets, are also crucial. Furthermore, implementing robust load balancing and failover mechanisms can ensure the system remains operational even under peak demand. Finally, regularly stress-testing the system under simulated high-load conditions can help identify and address potential bottlenecks before they impact users.

Sustainability Strategies

Ensuring the long-term sustainability of a Crypto Zoo ecosystem requires a holistic approach that considers environmental impact, economic viability, and community engagement. Economic sustainability can be achieved through carefully designed tokenomics, ensuring a fair distribution of rewards and incentivizing participation. This might involve incorporating mechanisms that discourage hoarding and encourage active participation within the ecosystem. Community engagement is vital for building a loyal and supportive user base, creating a sense of ownership and shared responsibility for the project’s success.

Resource Consumption and Environmental Impact Management, Crypto zoo

The environmental impact of blockchain technology is a growing concern. Crypto Zoos, like many blockchain-based projects, rely on energy-intensive consensus mechanisms. To mitigate this, the Crypto Zoo should actively explore and implement energy-efficient consensus mechanisms, such as Proof-of-Stake (PoS) instead of energy-intensive Proof-of-Work (PoW). Furthermore, a commitment to carbon offsetting initiatives can help neutralize the environmental footprint. Transparency in energy consumption and environmental impact reporting should be prioritized to build trust and accountability within the community. This could involve regularly publishing reports detailing energy usage and offsetting efforts. For example, a Crypto Zoo could partner with a reputable carbon offsetting organization and allocate a percentage of its profits towards environmental conservation projects. This demonstrates a commitment to responsible development and mitigates potential negative environmental consequences.

Future Trends and Innovations: Crypto Zoo

The future of Crypto Zoos hinges on the integration of emerging technologies and a proactive adaptation to evolving market dynamics. Successful Crypto Zoos will need to leverage innovation to enhance user experience, bolster security, and expand their functionalities beyond simple digital pet ownership. This will involve incorporating elements from the metaverse, integrating advanced AI, and navigating the complexities of decentralized governance structures.

The integration of cutting-edge technologies will be crucial in shaping the next generation of Crypto Zoos. This involves not just enhancing existing features but also exploring entirely new possibilities for user engagement and interaction within the virtual environment. The potential for growth and diversification is immense, depending on how effectively these technologies are harnessed.

Emerging Technologies Enhancing the Crypto Zoo Experience

The application of augmented reality (AR) and virtual reality (VR) technologies promises to significantly enhance user immersion. Imagine users interacting with their digital pets in a more realistic and engaging way, using AR overlays to see their creatures superimposed on the real world, or exploring richly detailed VR environments with their digital companions. This level of immersion would significantly elevate the overall experience, fostering stronger emotional connections between owners and their virtual pets. Furthermore, blockchain integration with the metaverse could allow for seamless transfer of digital pets between different virtual worlds and platforms. This interoperability is crucial for building a truly expansive and dynamic ecosystem.

Potential Future Applications and Use Cases

Beyond simple pet ownership, Crypto Zoos could evolve to offer diverse applications. Imagine Crypto Zoos incorporating elements of decentralized autonomous organizations (DAOs) where users can collaboratively manage and develop the platform, influencing future features and the direction of the project. Furthermore, the integration of play-to-earn (P2E) mechanics, where users can earn cryptocurrency by participating in various activities within the Crypto Zoo, could offer a new revenue stream for users and incentivize engagement. This model, already seen in successful games like Axie Infinity, could be adapted to the Crypto Zoo environment to create a sustainable and engaging ecosystem. Another exciting possibility is the development of breeding programs that allow users to breed unique and valuable digital pets with specific traits, fostering a vibrant marketplace and increasing the overall value of the Crypto Zoo ecosystem.

Evolution and Adaptation to Changing Market Conditions

The cryptocurrency market is known for its volatility. Crypto Zoos must be prepared to adapt to fluctuating token values and changing regulatory landscapes. This requires a multi-pronged approach. Firstly, a robust economic model that can withstand market fluctuations is essential. This could involve incorporating mechanisms that adjust in-game rewards or tokenomics based on market conditions. Secondly, constant monitoring of regulatory developments and proactive engagement with regulatory bodies will be crucial in ensuring the long-term sustainability of the Crypto Zoo. Lastly, fostering a strong and engaged community is paramount. A well-informed and active community can provide valuable feedback, contribute to the platform’s development, and help navigate challenges that arise from market volatility or regulatory changes. The successful navigation of these factors will determine the long-term viability and success of the Crypto Zoo concept.

Conclusion

Crypto Zoos represent a fascinating intersection of technology, finance, and community. While challenges remain regarding scalability, security, and regulation, the potential for innovation and disruption is undeniable. As the space evolves, a careful consideration of the economic models, governance structures, and user experience will be paramount to the success and sustainability of these unique digital ecosystems. The future of Crypto Zoos hinges on navigating these complexities and embracing emerging technologies to create a truly engaging and secure environment for users and developers alike.

The enigmatic world of crypto zoology, with its elusive creatures and speculative narratives, often mirrors the uncertainty inherent in cryptocurrency markets. Understanding the potential risks and rewards requires careful consideration, which is why exploring the ethical dimensions of crypto investment is crucial. For a deeper dive into responsible crypto participation, check out this insightful article on The Ethics of Crypto Investments.

Ultimately, navigating the crypto zoo, both real and metaphorical, necessitates a strong ethical compass.

The world of crypto zoology, with its elusive creatures and unexplained phenomena, often feels as fantastical as the complexities of cryptography. However, the future of crypto security might depend on understanding the very real threat posed by advancements in quantum computing, as explored in this insightful article: Quantum Computing and Its Impact on Crypto. The potential for quantum computers to break current encryption methods could fundamentally reshape the landscape of digital security, impacting even the most outlandish crypto zoological theories relying on secure data storage.

The world of crypto zoology, with its elusive creatures and speculative narratives, often mirrors the volatility of the cryptocurrency market. Understanding this market, however, is key to navigating its complexities, and a great place to start is with a comprehensive guide like Crypto Trading for Beginners. This knowledge can then be applied to better understanding the speculative nature of crypto zoo, allowing for a more informed and nuanced perspective on the field.