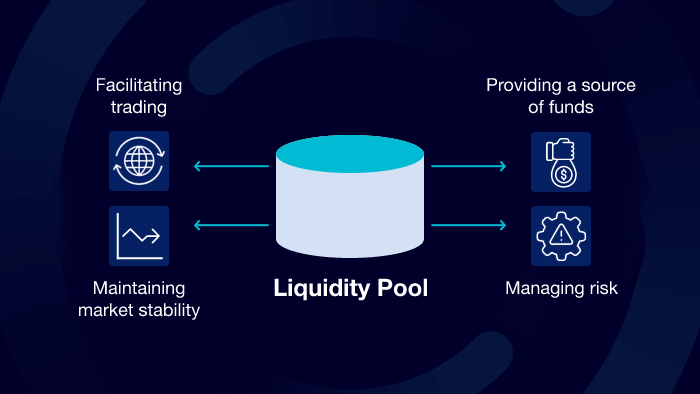

Understanding Liquidity Pools unveils a fascinating world within decentralized finance (DeFi). These pools, essentially collections of cryptocurrency assets locked in smart contracts, are the backbone of many decentralized exchanges (DEXs). They enable the seamless trading of cryptocurrencies without relying on centralized intermediaries. This exploration delves into their mechanics, risks, and the crucial role they play in the broader DeFi ecosystem.

Liquidity pools function by allowing users to exchange tokens directly with each other, facilitated by automated market makers (AMMs). These AMMs use algorithms to determine exchange rates based on the supply and demand within the pool. This differs significantly from traditional exchanges, which rely on order books matching buyers and sellers. Understanding the intricacies of liquidity pools, including concepts like impermanent loss and slippage, is key to navigating the world of DeFi.

Defining Liquidity Pools

Liquidity pools are essentially a collection of funds locked in a smart contract on a decentralized exchange (DEX). These funds, typically provided by users, are used to facilitate the trading of cryptocurrencies or other digital assets without relying on a centralized order book like traditional exchanges. Think of it as a shared reservoir of assets that traders can draw upon to execute their trades.

Liquidity pools are crucial for the functioning of decentralized finance (DeFi) platforms, providing the necessary liquidity for efficient and smooth trading. Their existence enables decentralized trading without the need for a central authority, a key feature of blockchain technology.

Components of a Liquidity Pool

A liquidity pool comprises two key components: the assets themselves and the smart contracts that govern their interactions. The assets are usually pairs of cryptocurrencies, although other assets like stablecoins or NFTs are becoming increasingly common. The smart contract acts as the custodian and enforcer of the rules that dictate how these assets are traded within the pool. This contract automatically executes trades based on a pre-defined algorithm, usually a formula that maintains a certain price ratio between the two assets.

Example of a Real-World Liquidity Pool

A widely known example is a liquidity pool on Uniswap, a prominent decentralized exchange. Let’s imagine a pool containing ETH (Ethereum) and USDC (USD Coin), a stablecoin pegged to the US dollar. Users provide both ETH and USDC to the pool in a specific ratio, for example, a 50/50 ratio by value. Traders can then swap ETH for USDC or vice-versa, directly interacting with the smart contract. The smart contract automatically adjusts the ratio of ETH and USDC in the pool based on the trades, ensuring a relatively stable price relationship (though slippage can occur, especially with large trades). The liquidity providers earn fees on each trade executed within the pool, proportional to their share of the total liquidity. This incentivizes users to contribute to the pool and maintain its liquidity.

Types of Liquidity Pools

Liquidity pools come in various forms, each with its own mechanism for managing assets and incentivizing participation. Understanding these differences is crucial for choosing the most suitable pool for your trading or yield farming strategies. The core distinction lies in how the pool manages the ratio of assets and the associated trading fees.

Constant Product Market Makers (CPMMs)

CPMMs, exemplified by Uniswap V2, utilize a constant product formula to determine exchange rates. This formula, typically x * y = k (where x and y represent the quantities of the two assets and k is a constant), ensures that the product of the two assets remains constant after each trade. This means that as one asset’s quantity increases, the other’s decreases proportionally, affecting the price. A key advantage of CPMMs is their simplicity and ease of implementation. However, they suffer from significant slippage, especially with large trades, as the price impact is substantial. Furthermore, they are inefficient in capital utilization, requiring large amounts of liquidity to cover a wide price range.

Concentrated Liquidity Pools (CLPs)

Concentrated liquidity pools, as seen in Uniswap V3, offer a significant improvement over CPMMs by allowing liquidity providers (LPs) to concentrate their liquidity within a specific price range. Instead of providing liquidity across the entire price spectrum, LPs can choose a narrow range where they expect trading activity to occur. This leads to significantly reduced slippage for trades within the chosen range and improved capital efficiency for LPs. However, impermanent loss, a risk inherent in all liquidity pools, remains a concern, and LPs must carefully choose their price ranges to mitigate this risk. If the price moves outside the defined range, the LP’s liquidity becomes effectively unusable until the price returns.

StableSwap Pools

StableSwap pools, often employed for stablecoins, are designed to minimize slippage when trading similar assets. They utilize a more complex formula than CPMMs, typically involving a curve that penalizes deviations from a 1:1 ratio. This design is effective in maintaining a stable exchange rate between pegged assets, making them ideal for trading stablecoins. The advantage is reduced slippage and more predictable pricing, particularly beneficial for stablecoin trading. However, the more complex algorithms can be harder to implement and understand. Furthermore, these pools can be vulnerable to manipulation if the peg of the stablecoins is broken.

| Feature | Constant Product (CPMM) | Concentrated Liquidity (CLP) | StableSwap |

|---|---|---|---|

| Liquidity Distribution | Uniform across the entire price range | Concentrated within a specified price range | Concentrated around a 1:1 ratio |

| Slippage | High, especially for large trades | Low within the specified range | Low for similar assets |

| Capital Efficiency | Low | High | Moderate |

| Impermanent Loss Risk | Present | Present, but potentially mitigated by range selection | Present, but often lower for stable assets |

Liquidity Pool Mechanics

Understanding the mechanics of a liquidity pool requires delving into the mathematical formulas that govern its operations and the potential risks involved for liquidity providers. These pools rely on a simple yet powerful principle: maintaining a constant product of the two assets within the pool. This, however, leads to interesting implications regarding price slippage and impermanent loss.

At its core, a liquidity pool operates based on a constant product formula. This ensures that the pool maintains a balanced ratio of the two assets. Let’s consider a pool with two tokens, X and Y. The constant product formula is typically represented as:

x * y = k

Where ‘x’ represents the quantity of token X, ‘y’ represents the quantity of token Y, and ‘k’ is a constant representing the total liquidity within the pool. This constant remains relatively unchanged unless liquidity is added or removed. The price of token X in terms of token Y is therefore determined by the ratio x/y. As traders swap tokens, the quantities of x and y change, but their product (k) remains consistent, at least theoretically. In practice, small variations occur due to fees.

Slippage in Liquidity Pools

Slippage refers to the difference between the expected price of a trade and the actual price executed. In a liquidity pool, slippage arises because the act of trading itself changes the ratio of tokens within the pool. Larger trades exert more pressure on the price, leading to greater slippage. For instance, a large buy order for token X will increase its price (in terms of Y) because the ratio x/y increases as x increases and y decreases to maintain k. This is because the buyer needs to provide more Y to purchase X, as the price of X goes up due to the changing ratio in the pool.

The magnitude of slippage depends on the size of the trade relative to the total liquidity in the pool. Smaller trades experience minimal slippage, while larger trades can lead to significant price deviations. This is a key consideration for traders, especially those executing large orders. Exchanges often display estimated slippage before a trade is confirmed, allowing users to assess the potential impact.

Understanding liquidity pools involves grasping the dynamics of decentralized exchanges. A key consideration is the impact of these pools on the broader crypto ecosystem, which is why learning about initiatives like Crypto Philanthropy: Giving Back with Blockchain is valuable. This helps illustrate how efficient liquidity pools can facilitate charitable giving and enhance the overall utility of cryptocurrencies.

Ultimately, understanding these mechanisms is crucial for navigating the complexities of the decentralized finance (DeFi) space.

Impermanent Loss Calculation and Impact

Impermanent loss is the potential loss incurred by liquidity providers when the price of the assets in the pool changes compared to holding those assets individually. It’s called “impermanent” because the loss only becomes realized when the liquidity provider withdraws their assets from the pool. If the price returns to its initial state when the assets were deposited, there is no net loss.

Calculating impermanent loss requires comparing the value of the liquidity provider’s initial investment with the value of their assets after withdrawal, considering the changes in the relative prices of the two tokens. There’s no single formula universally used, but various approaches exist, often involving comparing the value of the assets held in the pool versus holding them individually. While complex formulas exist, a simplified illustration can help understand the concept. Imagine a liquidity provider contributed equal amounts of tokens X and Y. If the price of X significantly increases relative to Y, the provider will receive more Y and less X when withdrawing. This may result in a lower overall value compared to simply holding X and Y individually.

The impact of impermanent loss can be substantial, particularly in volatile markets. For example, if one token experiences a significant price increase while the other remains relatively stable, the liquidity provider might experience a considerable impermanent loss compared to simply holding their initial assets. However, trading fees earned within the pool can partially offset this loss, but this is not always sufficient to completely compensate.

Understanding liquidity pools involves grasping how assets are exchanged within a decentralized exchange. A key factor influencing the efficiency of these pools is the ability to seamlessly transfer assets between different blockchains, a concept explored in detail at Interoperability Between Blockchains. This interoperability directly impacts the depth and breadth of liquidity available within the pools, ultimately affecting trading efficiency and price discovery.

The Role of Liquidity Providers

Liquidity providers (LPs) are crucial to the functioning of decentralized exchanges (DEXs). They supply the assets that make trading possible, earning rewards in return. Understanding their role involves examining both the incentives and the risks associated with this activity.

Liquidity provision is essentially a service that facilitates trading. LPs contribute to the overall health and efficiency of the DEX ecosystem, enabling users to seamlessly exchange cryptocurrencies. Their participation directly influences trading volume and price discovery.

Incentives for Liquidity Provision

Several factors motivate individuals to become liquidity providers. The primary incentive is the potential to earn fees generated from trading activity within the pool. These fees are typically distributed proportionally to the LPs’ share of the pool. Furthermore, some DEXs offer additional incentives, such as governance tokens or staking rewards, to attract and retain LPs. These extra rewards can significantly boost the overall profitability of liquidity provision. Finally, some LPs believe in the project’s success and are willing to contribute to its growth, even if the immediate financial returns are modest.

Risks Associated with Liquidity Provision

While the potential rewards are attractive, liquidity provision also carries inherent risks. Impermanent loss is a significant concern. This occurs when the price of the assets in the pool changes relative to each other since the time the LP deposited their assets. If the price ratio changes drastically, the LP might have earned more if they had simply held their assets. For instance, if an LP contributes an equal value of two tokens, and one token’s price significantly increases while the other’s price stays relatively stable, the LP will have less of the appreciating asset than they would have if they held it individually. Another risk is smart contract vulnerabilities. A bug or exploit in the DEX’s smart contract could lead to the loss of funds. Finally, the value of the assets in the pool is subject to market volatility. A sudden downturn in the market can significantly reduce the value of the LP’s holdings.

Factors Influencing Profitability of Liquidity Provision

The profitability of liquidity provision is a complex interplay of several factors. These include the trading volume of the pool, the size of the trading fees, the price volatility of the assets in the pool, and the existence of additional incentives offered by the DEX. High trading volume generally leads to higher fee earnings, while high volatility can increase the risk of impermanent loss. The specific token pair chosen also plays a crucial role; some pairs might have higher trading volume and thus higher fees, while others may be more susceptible to price fluctuations. Finally, the APR (Annual Percentage Rate) offered by the DEX provides a key indicator of potential profitability. It’s important to note that past performance does not guarantee future returns. For example, a liquidity pool with a high APR in the past might experience a decrease in profitability due to changes in trading volume or market conditions. LPs need to carefully consider all these factors before committing funds.

Liquidity Pool Interactions

Users interact with liquidity pools primarily through two main actions: swapping tokens and managing liquidity provision. Swapping allows users to exchange one token for another, while managing liquidity involves adding or removing tokens from the pool to earn trading fees. These interactions are crucial to the functionality and overall health of decentralized exchanges (DEXs) that rely on automated market makers (AMMs).

The process of interacting with a liquidity pool involves connecting a cryptocurrency wallet to the DEX platform and then executing the desired transaction. The underlying mechanics rely on algorithms that determine exchange rates based on the current ratio of tokens within the pool. This ensures a relatively smooth and automated trading experience for users, while simultaneously providing incentives for liquidity providers.

Token Swapping

Token swapping is the most common interaction with a liquidity pool. Users initiate a swap by specifying the amount of one token they wish to exchange and the desired receiving token. The DEX’s smart contract then calculates the amount of the second token to be received based on the current pool reserves and a formula, often a variation of the constant product formula (x*y = k, where x and y are the quantities of the two tokens and k is a constant). The transaction is executed, adjusting the pool’s token ratios accordingly. Slippage, the difference between the expected exchange rate and the actual rate, may occur due to changes in the pool’s balance during the transaction. For example, a user might want to swap 1 ETH for a certain amount of USDC. The smart contract, using the current ETH/USDC ratio in the pool, calculates the amount of USDC to be received, factoring in the trading fees that accrue to liquidity providers. The transaction then updates the pool’s ETH and USDC balances.

Adding and Removing Liquidity

Adding liquidity to a pool involves depositing an equivalent value of two tokens into the pool. Removing liquidity involves withdrawing the deposited tokens, along with any accumulated trading fees. The ratio of the deposited tokens must match the pool’s current ratio to maintain its balance. For example, if a pool has a 1:1 ratio of ETH and USDC, adding liquidity requires depositing an equal value of both ETH and USDC. The liquidity provider receives liquidity provider (LP) tokens representing their share of the pool. These LP tokens can be used to withdraw the deposited assets plus accumulated trading fees at any time. The process of removing liquidity involves burning the LP tokens and receiving the proportional share of the pool’s assets, again reflecting the updated token ratios.

A Step-by-Step Guide to a Token Swap

- Connect Wallet: Connect your compatible cryptocurrency wallet (e.g., MetaMask) to the decentralized exchange (DEX) platform.

- Select Tokens: Choose the token you want to swap (the “from” token) and the token you want to receive (the “to” token).

- Input Amount: Specify the amount of the “from” token you wish to exchange. The DEX will automatically calculate the approximate amount of the “to” token you’ll receive, taking into account the current pool ratio and any trading fees.

- Review Details: Carefully review the transaction details, including the exchange rate, fees, and slippage. Slippage is the difference between the expected and actual exchange rate due to changes in the pool’s balance during the transaction.

- Confirm Swap: Confirm the transaction by signing it using your wallet. This initiates the swap on the blockchain.

- Transaction Completion: Once the transaction is confirmed on the blockchain, the swap is complete, and the “to” tokens will be added to your wallet.

Automated Market Makers (AMMs)

Automated Market Makers (AMMs) are the backbone of many decentralized exchanges (DEXs), providing a crucial mechanism for trading cryptocurrencies without relying on traditional order books. Unlike centralized exchanges which rely on matching buy and sell orders, AMMs use algorithms to determine asset prices and facilitate trades directly from liquidity pools. This allows for 24/7 trading, increased accessibility, and reduced reliance on intermediaries.

AMMs function by employing mathematical formulas to calculate the price of an asset based on its ratio within a liquidity pool. This ratio is constantly adjusted as users buy and sell assets, creating a dynamic pricing mechanism. The liquidity pool itself is a collection of tokens locked in a smart contract, providing the assets needed for trades. The specific algorithm used significantly influences the behavior of the AMM and the trading experience it provides.

AMM Algorithms

Several different AMM algorithms exist, each with its own strengths and weaknesses. The choice of algorithm influences trading fees, price slippage, and the overall efficiency of the exchange.

The most common algorithm is the constant product market maker (CPMM), often represented by the formula x * y = k, where ‘x’ and ‘y’ represent the quantities of two assets in the pool, and ‘k’ is a constant. This formula ensures that the product of the two assets remains constant after each trade. A trade will always increase the quantity of one asset and decrease the quantity of the other, maintaining the constant product. This simplicity is a key advantage, but it also leads to price slippage, especially for large trades, as the price changes significantly during the trade execution. Uniswap V2 is a prime example of an exchange using a CPMM algorithm.

In contrast, constant sum market makers (CSMM) maintain a constant sum of assets within the pool. This approach can lead to less price slippage compared to CPMM, but it can be less efficient in certain market conditions. It’s less commonly used than CPMM in practice.

More advanced algorithms, such as those used in Uniswap V3, aim to address the limitations of CPMM. These often incorporate concentrated liquidity, allowing liquidity providers to focus their capital within specific price ranges. This enhances capital efficiency and reduces slippage for trades within those ranges. However, it requires more sophisticated management from liquidity providers and may lead to less liquidity outside of the concentrated ranges.

Implications of AMMs on Market Efficiency and Price Discovery

The widespread adoption of AMMs has significant implications for market efficiency and price discovery. The automated and decentralized nature of AMMs contributes to increased liquidity and accessibility in certain markets, particularly for less-traded assets. However, the algorithms used by AMMs can also introduce distortions. For instance, the inherent slippage in CPMM can affect price discovery, particularly during periods of high volatility or large trades.

Furthermore, the reliance on algorithmic pricing can lead to vulnerabilities. Impermanent loss, a risk faced by liquidity providers, is a direct consequence of the AMM’s pricing mechanism. This risk arises when the relative price of assets in the pool changes significantly, resulting in liquidity providers receiving less value when withdrawing their assets than they initially deposited. The magnitude of this risk depends on the chosen AMM algorithm and the volatility of the assets in the pool.

Despite these challenges, AMMs have democratized access to decentralized finance (DeFi) and fostered innovation within the cryptocurrency ecosystem. The ongoing development and refinement of AMM algorithms are aimed at addressing their limitations and enhancing their role in facilitating efficient and transparent markets.

Understanding liquidity pools involves grasping the mechanics of decentralized exchanges. A key consideration, however, is the ethical dimension of your participation; for a thoughtful discussion on this, check out this insightful article on The Ethics of Crypto Investments. Returning to liquidity pools, remember that understanding the risks involved is crucial before actively participating in these systems.

Governance and Security of Liquidity Pools

Liquidity pools, while offering exciting opportunities for yield farming and decentralized exchange (DEX) functionality, are not without inherent risks. Effective governance and robust security measures are crucial for ensuring the longevity and stability of these pools, protecting both liquidity providers (LPs) and users. This section explores the key vulnerabilities, mitigation strategies, and governance models that shape the security landscape of liquidity pools.

Potential Vulnerabilities and Mitigation Strategies

Several vulnerabilities can compromise the security and functionality of liquidity pools. These range from smart contract exploits to vulnerabilities in the governance structure itself. Effective mitigation requires a multi-faceted approach encompassing robust code audits, transparent governance, and proactive risk management.

- Smart Contract Exploits: Malicious actors can exploit vulnerabilities in the smart contracts governing the liquidity pool, potentially draining funds or manipulating prices. Mitigation involves rigorous code audits by reputable security firms, regular security updates, and the implementation of bug bounty programs to incentivize the discovery and reporting of vulnerabilities.

- Flash Loans: Flash loans, while legitimate tools for arbitrage, can be misused to manipulate prices within a liquidity pool and profit from the resulting arbitrage opportunity. Mitigation strategies include incorporating mechanisms to detect and prevent price manipulation attempts, such as slippage limits and time-based constraints on transactions.

- Oracle Manipulation: Many liquidity pools rely on external price oracles to determine asset values. If these oracles are compromised or manipulated, it can lead to inaccurate pricing and potential losses for LPs. Using multiple, decentralized oracles and implementing mechanisms to detect and respond to anomalous price feeds can mitigate this risk.

- Governance Attacks: If the governance model is poorly designed or susceptible to manipulation, malicious actors could potentially gain control and exploit the pool for their benefit. Robust governance mechanisms, including decentralized decision-making processes and mechanisms to prevent single points of failure, are essential.

Examples of Governance Models

The success of a liquidity pool’s governance model directly impacts its security and longevity. Different approaches exist, each with its own strengths and weaknesses.

- Decentralized Autonomous Organizations (DAOs): DAOs offer a decentralized governance structure where token holders can participate in decision-making processes. Successful examples include Uniswap’s governance model, which allows UNI token holders to vote on proposals related to protocol upgrades and development. However, challenges include the potential for attacks through manipulation of voting mechanisms and the complexity of coordinating large numbers of participants.

- Centralized Governance: In some cases, a single entity or a small group controls the governance of the liquidity pool. While this approach can offer faster decision-making, it introduces a significant single point of failure and raises concerns about transparency and potential for abuse. This model is generally less preferred due to its inherent centralization risks.

The Importance of Audits and Security Best Practices

Regular security audits by independent firms are paramount for identifying and addressing potential vulnerabilities in liquidity pool smart contracts. Best practices include:

- Formal Verification: Employing formal verification techniques can mathematically prove the correctness of smart contracts, reducing the likelihood of unforeseen vulnerabilities.

- Bug Bounty Programs: Offering financial rewards for identifying vulnerabilities incentivizes security researchers to scrutinize the code and report any flaws.

- Transparent Code: Making the smart contract code publicly available allows for community review and scrutiny, enhancing transparency and security.

- Regular Updates and Patches: Promptly addressing identified vulnerabilities through regular updates and patches is crucial for maintaining the security of the liquidity pool.

Impact on Decentralized Finance (DeFi): Understanding Liquidity Pools

Liquidity pools are foundational to the Decentralized Finance (DeFi) ecosystem, acting as the engine driving many of its core functionalities. Their existence allows for the creation of a permissionless, transparent, and automated financial system, fundamentally altering how financial transactions are conducted. Without efficient and readily available liquidity, the DeFi space would be severely hampered, limiting its growth and overall impact.

Liquidity pools contribute significantly to the growth and adoption of DeFi by enabling various applications that were previously impossible or highly inefficient. They provide the necessary infrastructure for decentralized exchanges (DEXs), lending and borrowing platforms, yield farming opportunities, and other innovative financial instruments. This readily available liquidity fosters a vibrant and dynamic ecosystem, attracting both users and developers. The increased accessibility and ease of use facilitated by liquidity pools significantly lower the barrier to entry for participation in DeFi, contributing to its wider adoption.

Decentralized Exchanges (DEXs)

Decentralized exchanges rely heavily on liquidity pools to facilitate token swaps. These pools provide the necessary liquidity for users to exchange tokens without relying on centralized intermediaries. The automated market maker (AMM) algorithms embedded within these pools ensure that trades are executed efficiently and transparently, based on pre-defined rules. The absence of centralized control makes DEXs more resilient to censorship and single points of failure, enhancing the security and trustworthiness of the DeFi ecosystem. Uniswap, a prominent example, showcases the transformative power of liquidity pools in creating a decentralized and accessible exchange. Its success demonstrates the significant role liquidity pools play in the widespread adoption of DEXs.

Lending and Borrowing Platforms

Liquidity pools are integral to the functionality of many decentralized lending and borrowing platforms. These platforms leverage liquidity pools to provide users with the ability to lend and borrow crypto assets without the need for traditional financial institutions. Users can deposit their assets into liquidity pools, earning interest in return, while borrowers can access these funds by paying interest. The decentralized nature of these platforms, enabled by liquidity pools, promotes transparency and reduces counterparty risk, leading to a more secure and efficient lending and borrowing environment. Aave and Compound are prime examples of platforms that have successfully integrated liquidity pools into their core functionality.

Yield Farming and Liquidity Mining

Liquidity pools have given rise to innovative strategies like yield farming and liquidity mining, where users deposit their assets into pools to earn rewards. These rewards, often paid in the form of governance tokens or other cryptocurrencies, incentivize users to provide liquidity and contribute to the stability of the DeFi ecosystem. This incentivization mechanism has driven significant growth in the total value locked (TVL) in DeFi protocols, demonstrating the effectiveness of liquidity pools in attracting capital and fostering growth. The rewards offered for providing liquidity are a crucial component of DeFi’s success.

Real-World Applications and Use Cases

Liquidity pools, while initially conceived for simple token swaps, have evolved into versatile tools powering a wide array of decentralized finance (DeFi) applications. Their core function—providing liquidity for automated trading—underpins many innovative services, extending far beyond basic exchange functionalities. This section explores these diverse applications and considers future possibilities.

Liquidity pools are not merely mechanisms for swapping tokens; they are the foundational building blocks for numerous DeFi services. Their capacity to provide readily available liquidity allows for the creation of complex financial instruments and services that would be impractical or inefficient with traditional methods.

Decentralized Exchanges (DEXs)

Decentralized exchanges rely heavily on liquidity pools. These pools provide the liquidity necessary for users to swap tokens without relying on a centralized entity. Popular DEXs like Uniswap, SushiSwap, and Curve Finance all utilize liquidity pools to facilitate trades. The efficiency of these exchanges is directly tied to the depth and breadth of the liquidity pools they utilize. A deeper pool, with more assets locked, leads to lower slippage and more stable pricing during transactions.

Yield Farming and Lending Protocols

Liquidity providers often earn rewards for contributing to liquidity pools. These rewards can take the form of trading fees, newly minted tokens, or other incentives offered by the platform. This process is often referred to as “yield farming,” and it attracts users seeking passive income opportunities. Furthermore, lending and borrowing protocols frequently leverage liquidity pools to manage their lending pools. A user deposits assets into a pool, and the protocol utilizes these assets for lending, earning interest for the user while providing liquidity for borrowing. A prime example is Aave, a popular DeFi lending platform that utilizes liquidity pools extensively.

Stablecoin Mechanisms, Understanding Liquidity Pools

Certain liquidity pools are specifically designed to maintain the peg of stablecoins. These pools, often employing algorithmic mechanisms, incentivize trading activity that keeps the stablecoin’s price close to its target value (e.g., $1). This is crucial for maintaining the stability and trust in the DeFi ecosystem. The design and operation of these pools are complex and require sophisticated algorithms and governance mechanisms to ensure stability.

Future Applications and Developments

The potential future applications of liquidity pools are vast. One area of development involves the integration of more complex financial instruments, such as derivatives and options, into liquidity pools. This could lead to more sophisticated trading strategies and a wider range of DeFi products. Another promising area is the development of more efficient and secure mechanisms for managing liquidity pools, including improvements in governance models and risk management strategies. The integration of artificial intelligence (AI) and machine learning (ML) to optimize liquidity pool management and predict market trends could also significantly impact their efficiency and profitability. The combination of these technologies could lead to more resilient and adaptable liquidity pools, better equipped to handle volatile market conditions. For instance, AI-driven algorithms could dynamically adjust parameters within a pool to optimize liquidity based on real-time market data, potentially mitigating the risks of impermanent loss.

Risks and Challenges

Liquidity pools, while offering exciting opportunities within the DeFi ecosystem, are not without their inherent risks and challenges. Understanding these potential pitfalls is crucial for both liquidity providers and users interacting with these decentralized platforms. Failure to account for these risks can lead to significant financial losses.

The decentralized and often unregulated nature of many liquidity pools introduces unique vulnerabilities. These range from smart contract vulnerabilities and impermanent loss to broader systemic risks impacting the entire DeFi landscape. Regulatory uncertainty further complicates the situation, leaving many projects in a gray area regarding compliance and legal frameworks.

Impermanent Loss

Impermanent loss is a key risk for liquidity providers. It arises from price fluctuations between the two assets in a liquidity pool. If the price ratio of the assets changes significantly from when you provided liquidity, you may end up with less value than if you had simply held the assets individually. For example, imagine you provide liquidity with an equal value of Asset A and Asset B. If the price of Asset A doubles while the price of Asset B remains unchanged, you will have less of Asset A and more of Asset B when you withdraw your liquidity, resulting in an impermanent loss compared to holding the assets individually. This loss is “impermanent” because it can be reversed if the price ratio returns to its original state. However, significant and prolonged price divergence can result in substantial losses.

Smart Contract Risks

Liquidity pools rely heavily on smart contracts. Bugs or vulnerabilities in these contracts can be exploited by malicious actors, leading to the loss of funds. The decentralized nature of these platforms makes auditing and securing these contracts challenging, increasing the risk of exploits and hacks. High-profile hacks of decentralized exchanges (DEXs) that utilize liquidity pools highlight the severity of this risk. Thorough audits and security reviews are crucial but don’t guarantee complete protection.

Regulatory Uncertainty

The regulatory landscape surrounding DeFi and liquidity pools is still evolving. Many jurisdictions lack clear guidelines on how to classify and regulate these platforms, leading to uncertainty for projects and users. This uncertainty can hinder innovation and create legal risks for projects operating in different jurisdictions. Potential regulatory actions, such as increased scrutiny or outright bans, could significantly impact the liquidity pool market.

Systemic Risks

The interconnectedness of the DeFi ecosystem exposes liquidity pools to systemic risks. A major event, such as a large-scale hack or a significant market downturn, can have cascading effects across the entire system, impacting the value of assets locked in liquidity pools. The lack of centralized control makes it difficult to mitigate these risks effectively. The collapse of TerraUSD stablecoin in 2022 demonstrated the potential for systemic risk to severely impact DeFi projects, including those relying on liquidity pools.

Future Challenges

Several future challenges need addressing to ensure the long-term viability and sustainability of liquidity pool technology. These challenges require collaborative efforts from developers, regulators, and the broader DeFi community.

- Scalability: As the adoption of DeFi grows, liquidity pools need to handle an increasing volume of transactions efficiently and cost-effectively. Current solutions often struggle with scalability, leading to high gas fees and slow transaction speeds.

- Interoperability: Different blockchain networks and liquidity pools often operate in silos. Improving interoperability between these platforms is crucial for creating a more seamless and integrated DeFi ecosystem.

- User Experience: Many liquidity pool interfaces are complex and difficult for average users to understand. Improving the user experience is vital for broader adoption and to reduce the risk of users making uninformed decisions.

- Oracle Manipulation: Many AMMs rely on oracles to provide price feeds. Manipulating these oracles can distort the prices used by the AMM, leading to arbitrage opportunities and potential losses for liquidity providers.

Closing Summary

In conclusion, understanding liquidity pools is essential for anyone involved in or interested in the decentralized finance landscape. While they offer exciting opportunities for participation and yield generation, it’s crucial to be aware of the associated risks, including impermanent loss and smart contract vulnerabilities. By carefully considering the various types of liquidity pools and the mechanics behind them, individuals can make informed decisions and participate effectively in this dynamic and evolving ecosystem. The future of DeFi hinges on the continued development and refinement of liquidity pool technology, promising further innovation and expansion in the years to come.